Boeing’s stock has declined since one of its aircraft experienced a dramatic midair explosion in the United States.

A cabin panel ripped off an Alaska Airlines-operated 737 Max 9, necessitating an emergency landing and prompting safety officials to ground other aircraft of the same model equipped with the faulty door plug.

Monday closed with shares of the American aircraft manufacturer declining by 8%, while shares of supplier Spirit Aerosystems fell by 11%.

The occurrence exacerbated the quality concerns that the companies were already confronting.

It is more about the overall perception of Boeing as an operator and its long-term safety record, according to aviation analytics firm OAG chief analyst John Grant.

A multitude of discrete occurrences is accumulating to form an extensive inventory of issues for Boeing, as well as for their airline clients who are reliant on these aircraft.

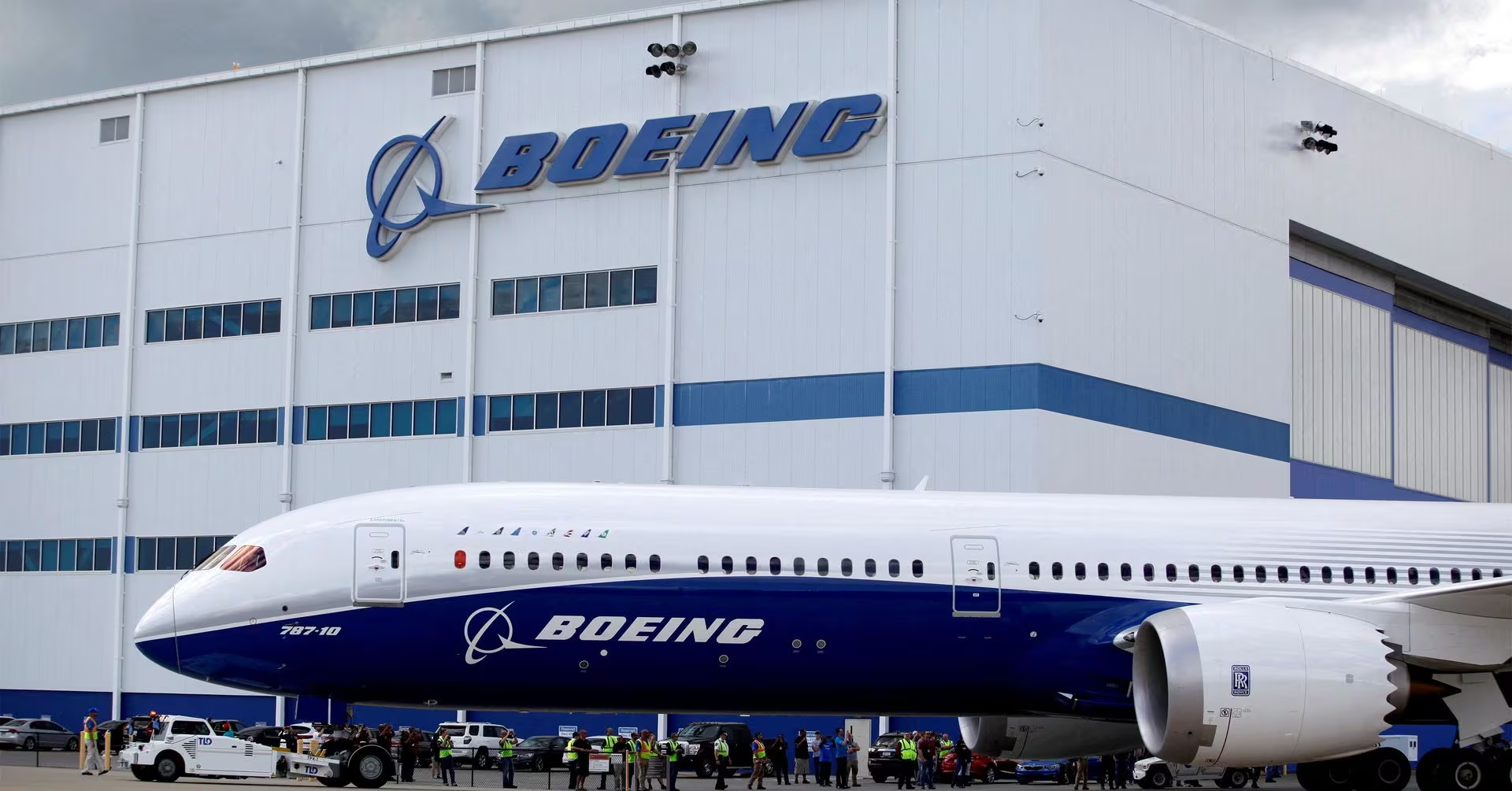

Boeing’s Struggle Amid Quality Concerns

Boeing has been striving to recover from the repercussions of two high-profile accidents that occurred in 2018 and 2019, involving an alternative 737 model, the Max 8, resulting in the loss of 346 lives.

Boeing has been developing the 737 Max to improve short- and medium-distance fuel efficiency since 2011.

Although it has garnered favour among airlines, it has been beset by quality concerns stemming from electrical malfunctions, loose fasteners, and additional complications, some of which have also implicated Spirit AeroSystems.

Prior to the emergency near the airport in Portland, Oregon, safety advocates had already become aware of the firms’ past.

The Federal Aviation Administration grounded 171 of the fleet of over 200 737 Max 9 aircraft for inspection following the incident, resulting in the cancellation of hundreds of flights on Alaska, United, and other airlines.

On Monday, United announced that initial examinations had revealed occurrences of installation complications pertaining to the door lock. The issues included “bolts that required tightening.”

The shares declined in afternoon trading following the news.

Boeing Faces Scrutiny Amid Supply Chain Challenges

According to analyst Mr. Grant, the industry as a whole has been experiencing supply chain issues. This has led to difficulties in delivering aircraft on time, increasing the pressure to move more rapidly.

After two years, Boeing may have forgotten something and has yet to address it.

Boeing is undoubtedly going to be scrutinized once more.

The assembly under scrutiny was not discovered on any other Max aircraft, Boeing stated earlier on Monday. The company maintained its dedication to safety and cooperation with regulatory bodies.

The component was manufactured and installed by Spirit AeroSystems, which appointed a new CEO in October. On Monday, it stated that “the quality and product integrity of the aircraft structures we deliver” is its “primary focus”.

Spirit said in a statement, “We are grateful the Alaska Airlines crew followed the proper procedures to land the aircraft safely with all passengers and crew intact.”

Spirit and Boeing maintain a steadfast partnership regarding the 737 programme, and our collaboration persists in this regard.

A few months prior to Friday’s emergency, the aircraft in question had received flight clearance and been placed into service.

Alaska Airlines warned it for pressurization concerns and prohibited its use on long water flights.

After the accidents in 2018 and 2019, Airbus, Boeing’s archrival, has risen to become the leading global aircraft supplier. This ascent has resulted in an increase in its market share.

Monday in trading, shares of the European firm increased by more than 3 percent.